The Maharashtra state government launched the Annasaheb Patil Loan Scheme 2025. To provide financial support to the financially unstable citizens of Maharashtra state and allow them to start their self-employment journey, the Maharashtra state government launched the Annasaheb Patil Loan Scheme 2025. With the help of financial help, the Maharashtra state government will encourage the citizens of the state to become entrepreneurs and start their own businesses. According to the information, the Maharashtra state government will provide financial assistance of INR 10 lakh to 50 lakh to all the selected beneficiaries. The citizens can visit the official website and fill out the application form to avail of the benefit.

Objective of Annasaheb Patil Loan Scheme 2025

The main objective of launching the scheme is to help the financially unstable citizens of Maharashtra state by providing loans. With the help of the loan scheme, unemployed citizens can start or expand their own businesses which will also increase employment opportunities for others. All the applicants who will receive financial assistance in the form of a loan under the scheme will have 5 years to pay the loan amount back. This initiative aims to empower individuals, especially unemployed youth and economically weaker sections. All the applicants player the eligibility criteria must visit the official website and fill out the application form to avail the benefits of this scheme.

Also Read: Inter Caste Marriage Scheme Maharashtra

Helpful Summary of Annasaheb Patil Loan Scheme

| Key Highlights | Details |

| Name of the Scheme | Annasaheb Patil Loan Scheme |

| Launched By | Maharashtra state government |

| Launch Date | 2025 |

| Announced By | Maharashtra State Chief Minister |

| Purpose | Provide loan |

| Beneficiaries | Citizens of Maharashtra |

| Target Beneficiaries | Financially weak citizens |

| Advantage | Provide a loan for self-employment |

| Eligibility Criteria | Citizens of Maharashtra |

| Required Documents | Aadhaar Card, Bank account |

| Application Process | Online |

| Official Website | Udyog Mahswayam website |

| Expected Benefits | Loans of up to INR 10 lakh to 50 lakhs |

Eligibility Criteria

- The citizens must be permanent residents of Maharashtra state.

- If the loans are approved without Collateral by banks can be eligible for a guarantee under the Mandal loan scheme.

- The selected citizens must have the Mandal’s eligibility certificate to apply.

- After the loan is approved the loan details including amount and disbursement must be uploaded into the mandals web system.

- Is the Collateral guarantee necessary the Mandal will assess and approve as required.

Type of Loans Under the Scheme

- Personal Loan Interest Repayment Plan

- Group Loan Interest Repayment Scheme

- Group Project Loan Scheme

Also Read: Maharashtra Vidhwa Pension

Interest Rate and Charges

- The interest rate under the Annasaheb Patil Loan Scheme 2025 is 12% per annum.

- Minimal charges may be applied to documentation according to the bank.

Required Documents

- Identity proof

- Adress proof

- Income proof

- Caste Certificate

- Business plan/project

- Bank account details

Benefits of Annasaheb Patil Loan Scheme

- The Annasaheb Patil Loan Scheme will provide financial assistance in the form of loans to the financially unstable citizens of Maharashtra state.

- A loan of INR 10 lakh to 50 lakh will be given to the selected applicants under the scheme.

- With the help of the loan under the scheme, unemployed citizens can start their own businesses which will also create employment opportunities for others.

- The applicants will get sufficient 5 years to pay back the loan amount under the Annasaheb Patil Loan Scheme.

- The financial assistance will be transferred directly to the selected applicant’s bank account

Salient Features

- Loan amount: The loan amount of up to INR 10 lakh to 50 lakh will be given to the selected citizens.

- Repayment period: The citizens can repay the loan under the scheme within 5 years.

- Objective: The main objectives of launching the scheme is to allow the financially weak citizens to start their own business.

- Beneficiaries: All the financially weak citizens of Maharashtra state who have a proper business plan are eligible to apply.

Also Read: Maharashtra Pink e Rickshaw Scheme

Annasaheb Patil Loan Scheme Application Process

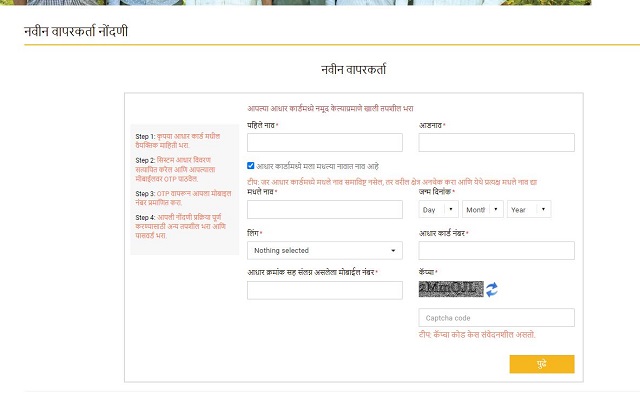

STEP 1: All the applicants who want to apply for the scheme can now go to the official Udyog Mahswayam website and fill out the application form online.

STEP 2: Once the applicant reaches the home page of the official website the applicant must click on the option Register Now.

STEP 3: A new page will appear on your desktop screen the applicant must enter all the details including their name, date of birth, gender, Aadhar card, and registered mobile number.

STEP 4: After entering all the details carefully the applicant must click on the option Next.

STEP 5: Once the applicant clicks on the option next the applicant will receive a OTP on the mobile number that he has entered.

STEP 6: The applicant must enter the OTP that he has received on the registered mobile number.

STEP 7: The applicant must Now enter all other details and click on the option submit to complete their process.

Contact Details

- Phone No:- 1800-120-8040

FAQs

Who is eligible to avail of the benefits of the Annasaheb Patil Loan Scheme?

All the permanent residents of Maharashtra state are eligible to avail of the benefits of the Annasaheb Patil Loan Scheme.

What is the tenure of the loan under the Annasaheb Patil Loan Scheme?

The tenure of the loan under the scheme is 5 years.

What is the loan amount to be given to the selected applicants under the Annasaheb Patil Loan Scheme?

A loan of INR 10 lakh to 50 lakh will be given to the selected applicants under the Annasaheb Patil Loan Scheme.