The Government of India launched the Credit Guarantee Scheme for MSME 2025. To provide term loans to the small and micro enterprises in India so that they can buy their machinery the finance minister of India introduced the Credit Guarantee Scheme for MSME 2025. With the help of the scheme, small and micro enterprises did not have to pay any Collateral or third-party guarantees on the purchase of machinery. The Government of India will set up a guarantee fund of up to INR 100 crore for each applicant. All the applicants who clear the eligibility criteria must go to the official website and fill out the application form online.

Credit Guarantee Scheme for MSME Announced in Budget 2025

During the Representation of the union budget for the Year 2024-25, the financial minister of India Nirmala Sitharaman introduced the scheme. This scheme was launched to help small and micro Enterprises business owners. According to the government, small and micro-enterprise owners do not have to pay any collateral or third-party guarantee to purchase machinery under this scheme. With the help of this scheme, small and micro-enterprise owners are eligible to buy expensive machinery without worrying about financial troubles. This scheme will significantly increase the business of small and micro enterprises in India.

Also Read: Mudra Loan Scheme 2.0

Rs 100 Crore Credit Guarantee Scheme will Release Soon

The Finance Minister of India Mrs. Nirmala Sitharaman has announced that the Rs 100 Crore Credit Guarantee Scheme will soon be approved by the Union Cabinet of India and will be ready to launch. The scheme will be very beneficial for all the small and micro enterprises in India because they will get credit facilities from the government. The scheme was first introduced by the Finance Minister during the announcement of the union budget for the financial year 2024-25. After the approval, the authorities will set up MSME centres or banks to provide the guarantee under the scheme.

The objective of the Credit Guarantee Scheme

The main objective of launching this scheme is to help small and micro-business enterprises expand their business. By purchasing machinery of the latest technology small and micro enterprises can increase their production significantly. Under the scheme, the Government of India will provide a guarantee fund of INR 100 crore for each small and micro-enterprise in India. The borrowers will be required to pay an upfront guarantee fee and an annual fee based on the reduced loan balance. This scheme will uplift the social status and standard of living of all the small and micro business owners in India.

Helpful Summary of Credit Guarantee Scheme for MSME

| Name of the scheme | Credit Guarantee Scheme for MSME |

| Introduced by | Government of India |

| Objective | Provide financial assistance |

| Beneficiaries | Small and micro business owners |

| Official website |

Eligibility Criteria

- The applicant must be a permanent resident of India.

- The applicant must be a small and micro business owner.

Benefits of Credit Guarantee Scheme

- With the help of this scheme, the Government of India will provide a credit guarantee fund to all small and micro business owners.

- A total of 100 crores of credit guarantee will be given to each MSME owner under the scheme.

- With the help of this scheme, MSME owners can buy machinery with the latest technology without worrying about financial trouble.

- Small and microbial enterprises can increase their business significantly with the help of this scheme.

Also Read: NPS Vatsalya Scheme

Date of Announcement

- The with the help of this scheme was announced on Tuesday 23rd July 2024.

Required Documents

- Aadhar Card

- Ration card

- Mobile Number

- Electricity bill

- Address Proof

- PAN Card

Credit Guarantee Scheme for MSME Apply Online 2025

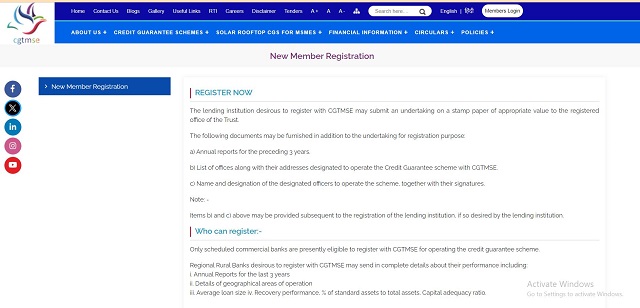

STEP 1: All the applicants who clear the eligibility criteria must visit the official CGTMSE website and fill out the application form to avail of the benefits of the Credit Guarantee Scheme for MSME.

STEP 2: Once the applicant reaches the homepage of the official website the applicant must click on the option New Member Registration.

STEP 3: A new page will appear on your desktop screen the applicant must enter all the details that are asked and attach all the necessary documents on the application form.

STEP 4: After entering all the details the applicant must quickly review it and click on the option submit to complete their process.

Credit Guarantee Scheme for MSME Offline Application Process

STEP 1: To apply for the scheme offline the applicants are requested to visit the nearest bank branch or regional office.

STEP 2: Once the applicant reaches the official Bank branch or regional office the applicant must consult with the concerned official.

STEP 3: From the concerned official the applicant will receive an application form. The applicant must fill out all the details that are asked for and attach all the necessary documents on the application form.

STEP 4: After entering all the details the applicant must quickly review it and submit the application form to the concerned official.

Contact Details

- Phone No:- (022): 6722 1553, 6722 1438, 6722 1483

FAQs

When was the Credit Guarantee Scheme for MSME announced?

The scheme was announced during the representation of the union budget for the financial year 2024-25 Credit Guarantee Scheme for MSME.

What is the total credit guaranteed that the government will provide?

The total credit guarantee of INR 100 crore will be provided by the government of India for every MSME owner.

What is the main objective of launching the Credit Guarantee Scheme for MSME 2025?

The main objective of launching the scheme is to help the MSME owners with the latest machinery without worrying about financial troubles.