The Government of India has launched the Mahila Samman Savings Certificate Calculator 2025. All the female citizens of India who have applied for the Mahila Samman saving certificate scheme can now visit the official website to check their total amount. The female citizens just need to enter their deposit amount to check the total amount that they will generate after a tenure of 2 years. All female citizens of India without any age or income restrictions are eligible to avail the benefits of the Mahila Samman Saving Scheme. Download. Female citizens can calculate their total amount online in the comfort of their homes without visiting anywhere.

What is the Mahila Samman Savings Certificate Scheme?

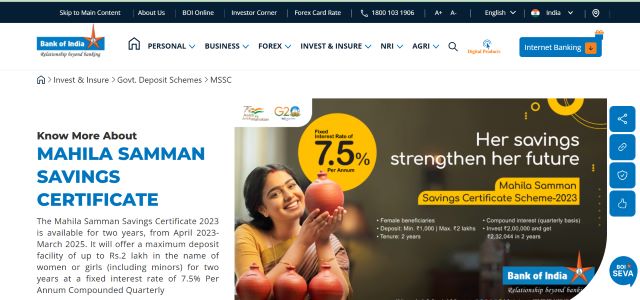

The Department of Economic Affairs under the Ministry of Finance is the nodal department that administrates the working of the Mahila Samman Savings Certificate Scheme. The authorities launched the scheme on April 1, 2023, and it is valid for two years, until March 31, 2025. The female citizens of India did not have to take any risk at all to invest their money under the scheme and could easily cash out their deposit amount after 2 years. According to the information the current interest rate under the Mahila Samman saving certificate scheme is 7.5% per annum.

The objective of Mahila Samman Savings Certificate

The main objective of launching the Mahila Samman Savings Certificate is to allow female citizens to invest their ideal money without any risk of losing it. With the help of this scheme, female citizens can invest their money for a very short tenure of 2 years with a higher interest rate. This program is open to all women, including married women, widows, and disabled women. Under this scheme, female citizens can deposit a maximum amount of up to INR 2 lakh and a minimum of INR 1000.

Helpful Summary of Mahila Samman Savings Certificate Calculator

| Key Highlights | Details |

| Name of the Scheme | Mahila Samman Savings Certificate Calculator |

| Launched By | Government of India |

| Launch Date | April 1, 2023 |

| Announced By | Prime Minister of India |

| Purpose | Invest money |

| Beneficiaries | Citizens of India |

| Target Beneficiaries | Female citizens |

| Advantage | Higher interest rate |

| Eligibility Criteria | Female citizen |

| Required Documents | Aadhaar Card, Bank account |

| Application Process | Online |

| Expected Benefits | Investing opportunity for 2 year |

Eligibility Criteria

- The citizens must be a permanent resident of India.

- The citizens must be female citizens.

- In the case of minors, the legal guardians or parents of the girl child can apply.

Benefits of Mahila Samman Savings Certificate Calculator

- With the help of this scheme, female citizens can invest their idol money without taking any risk of losing it.

- Under this scheme, the central government of India will provide an interest rate higher than any other savings account which is 7.5% per annum.

- Because the maturity period under the scheme is only 2 years female citizens can invest their money for the short term.

- This Mahila Samman Savings Certificate scheme will help female citizens to develop a habit of saving.

Also Read: Post Office Scheme for Women

Contribution Amount (Minimum and Maximum)

- An account may be deposited with a minimum of INR 1000/-and any amount in multiples of one hundred rupees; however, further deposits will not be accepted in that account.

- The maximum amount that can be deposited under the scheme is INR 2 lakh.

Interest Rates

- The interest under the Mahila Samman Savings Certificate scheme is 7.5% per annum.

Maturity and Withdrawal

- The maturity period under the scheme is 2 years the female citizens can receive their eligible balance after completing the periods.

- Female citizens are eligible to withdraw only 40% of The Eligible balance once the account has been opened for a year but before it matures.

- If a minor girl’s account was opened on her behalf, her guardian may request a withdrawal on her behalf by bringing the appropriate certificate to the accounts office.

- Any amount in fractions of a rupee will be rounded to the closest rupee for determining the withdrawal from the account, and for this reason, any amount beyond fifty paise will be considered one rupee, while any amount below fifty paise will be disregarded.

Premature Closure

An MSSC account can be opened for a maximum of two years, and it cannot be closed before that time unless one of the following circumstances occurs:

- When an account holder passes away and the bank is satisfied that the account holder is suffering undue hardship due to the operation or continuation of the account—for example, due to medical support for a life-threatening illness or the death of a guardian—it may, upon thorough documentation, by order, and for reasons documented in writing, permit the account to be closed early. Interest on the principal amount of an account that is closed early will be paid at the rate that applies to the scheme that the account has been held for (without net of any interest that may be owed).

- Any time after the six months have passed since the account was opened for any of the other reasons listed above, an account may be prematurely closed. In this scenario, the balance in the account as of any given time will only be eligible for interest at a rate that is two percent (2%) less than the scheme’s specified rate.

MSSC Calculator

*Maturity amount shown here is indicative only. Subject to change based on interest rate advised by Govt. from time to time.

| Amount | Amount in Rs |

|---|---|

| Total Deposit Amount | ₹ |

| Total Interest | ₹ |

| Maturity Amount | ₹ |

Mahila Savings Samman Calculator (MSSC)

The Mahila Savings Samman Yojana uses a simple interest formula to calculate the maturity amount, based on the deposit, interest rate, and time period (in years).

Formula for Simple Interest (SI):

Where:

- ( P ) = Principal amount (initial deposit)

- ( R ) = Rate of interest per annum (as a percentage)

- ( T ) = Time period in years

Maturity Amount (A):

Where:

- ( A ) = Maturity amount (total amount received at the end of the term)

- ( P ) = Principal amount (initial deposit)

- ( SI ) = Simple interest earned over the period

Example Calculation:

If you deposit ₹2,00,000 for 2 years at an interest rate of 7.5%:

- Principal (P) = ₹2,00,000

- Interest Rate (R) = 7.5% per annum

- Time (T) = 2 years

Step-by-Step Calculation:

- Calculate Simple Interest:

- Total Interest (for 2 years) = ₹30,000

- Maturity Amount (A) = ₹2,00,000 (Principal) + ₹30,000 (Interest) = ₹2,30,000

So, the maturity amount after 2 years is ₹2,30,000.

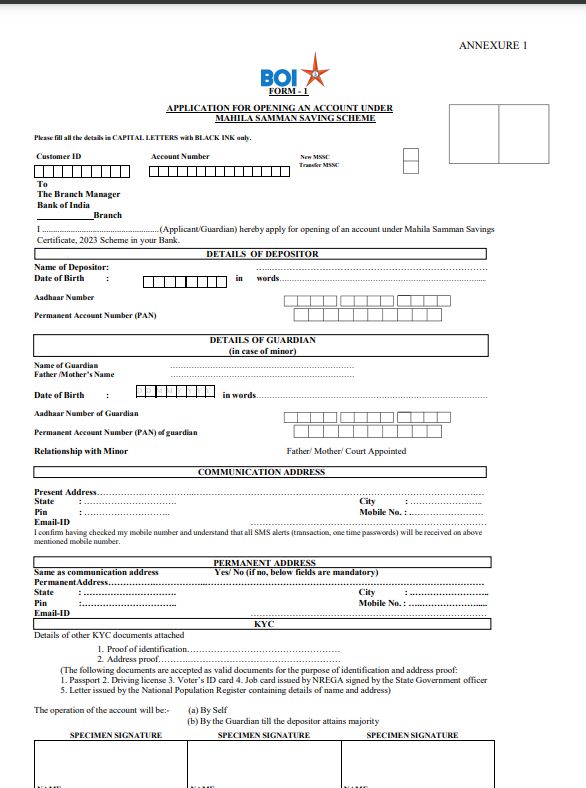

Mahila Samman Savings Certificate Application Form

STEP 1: All female citizens of India who want to fill out the application form for the Mahila Samman saving certificate scheme are requested to visit the official website to download the application form or take it from the bank branch.

STEP 2: After taking the application form the female citizens must start filling it by entering all the details that are asked and attaching all the necessary documents.

STEP 3: Now the female citizens must submit the application form back to the bank official along with the initial deposit amount.

Download Registration Form

STEP 1: All the female citizens of India who want to download the registration form for the Mahila Samman saving certificate scheme can now visit the official website.

STEP 2: Once the female citizens reach the homepage of the official website they must locate and click on the option called “download forms”.

STEP 3: Now the female citizens can click on the option “account open form” to successfully download their registration form.

Contact Details

- For Domestic(India) Contact:

- 1800 103 1906 (toll free)

- 1800 220 229 (toll free)

- (022) – 40919191 (Chargeable number) 24X7

- Email: cgro.boi@bankofindia.co.in

FAQs

Which department administrates the working of Mahila Samman saving certificate scheme?

The Department of Economic Affairs under the Ministry of Finance is the nodal department that administrates the working of the Mahila Samman Savings Certificate Scheme.

Who is eligible for this Mahila Samman Savings Certificate Scheme?

Only female citizens of India are eligible to avail the benefits of the Mahila Samman Savings Certificate Scheme.

What is the minimum investment for this Mahila Samman Savings Certificate Scheme?

The minimum deposit that can be made under the Mahila Samman Savings Certificate Scheme is INR 1000.