The Government of India launched the Mudra Loan Scheme 2.0. To provide financial loan facilities to income-generating micro-enterprises engaged in the non-farm and non-corporate sectors, the Government of India introduced the Mudra Loan Scheme 2.0. Under this scheme, small enterprises are eligible to receive a total loan amount of INR 10 lakh. With the help of the loan facility, small and micro enterprises can grow their business significantly without worrying about financial troubles. All the applicants who clear the eligibility criteria must go to the official website to fill out the application form online to avail the benefits of this scheme.

Revised Mudra Loan Scheme 2.0

During the Representation of the union budget of 2025, the finance minister of India announced the launch of the revised Mudra Loan Scheme 2.0. Under the revised version of the Mudra scheme, the Government of India increased the loan amount by 10 lakh making a total of INR 20 lakh. The selected applicants under the scheme are eligible to receive a total loan amount of INR 20 lakh from the Government of India. The loan amount was increased to further enhance the small and micro enterprises in India. The increment in the loan amount under the Mudra scheme will give more opportunities to small and micro enterprises.

Also Read: Education Loan e Voucher Scheme

Objective of Mudra Loan Scheme

The main objective of launching the Mudra loan scheme is to help small and micro business owners so that they can expand their business. The expansion of small and micro businesses will significantly create a lot of opportunities for unemployed citizens. According to reports, the Government of India sanctioned a total of 5.4 lakh crore loans under the Mudra Loan Scheme. This scheme will encourage the citizens of India to start their own small businesses. There are three types of loans under the scheme that will be provided to small and micro enterprises.

Eligibility Criteria

- To avail of the loan under the Mudra Loan Scheme the applicant must be-

- Small manufacturing enterprise

- Shopkeepers

- Fruit and Vegetable vendors

- Artisans

- Truck operators

- Food service units

- Repair shop

Type of Mudra Loans

- The Shishu category provides loans of up to INR 50,000.

- The Kishor category provides loans from INR 50,000 to INR 5 lakh.

- The Tarun category provides loans from INR 5 lakh to INR 10 lakh.

Required Documents

- Aadhar Card

- Ration card

- Mobile Number

- Electricity bill

- Address Proof

- PAN Card

Also Read: PMFME Loan

Benefits of Mudra Loan Scheme

- With the help of the Mudra Loan Scheme, small and micro enterprises can expand or start their business.

- It will also create employment opportunities for other unemployed citizens.

- Now small and micro enterprises are eligible to receive loans of up to INR 20 lakh.

- The financial assistance under the scheme will be transferred directly to the selected applicants’ bank accounts.

Mudra Loan Scheme 2.0 Apply Online

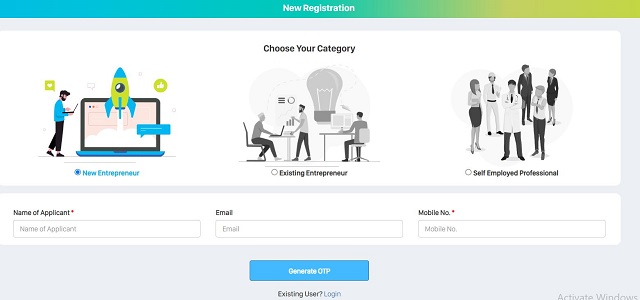

STEP 1: All the applicants who clear the eligibility criteria must visit the official website and fill out the application form to avail of the benefits of the Mudra Loan Scheme 2.0.

STEP 2: Once the applicant reaches the homepage of the official website the applicant must click on the option Udaymimitra portal.

STEP 3: A new page with appear on your desktop screen the applicant must click on the option apply now.

STEP 4: On the new page the applicant must enter their name, email, and mobile number and click on the option generate OTP.

STEP 5: Now the applicant must enter the OTP that they have received on the registered mobile number and click on the option submit.

STEP 6: The registration form will appear on your desktop screen the applicant must enter all the details that are asked and attach all the necessary documents.

STEP 7: After entering all the details the applicant must quickly review it and click on the option submit complete their process.

Mudra Loan Scheme Offline Application Procedure

STEP 1: All the applicants who want to apply for the scheme offline can visit the nearest Commercial Banks, RRBs, Small Finance Banks, MFIs, and NBFCs.

STEP 2: The application form to apply for the scheme is available online on the official. the applicants can just go to the official website and click on any loan category.

STEP 3: The applicants can click on the option Shishu, Kishor, and Tarun to download the application form easily.

STEP 4: After downloading the application form the applicant must fill out all the details and attach any necessary documents including address proof and identity proof.

STEP 5: After filling out the application form the applicant must quickly review it and submit the application form to the concerned official.

Contact Details

- help[at]mudra[dot]org[dot]in

FAQs

What is the main objective of launching the Mudra Loan Scheme 2.0?

The main objective of launching Mudra Loan Scheme 2.0 is to help small and micro-business enterprises in India.

What is the maximum amount of loan to be given under the Mudra Loan Scheme 2.0?

The maximum amount of loan to be given under the scheme is INR 20 lakh.

Who is eligible to avail the benefits of the Mudra Loan Scheme 2.0?

All the small and micro business owners in India are eligible to available the benefits of the Mudra Loan Scheme 2.0