Indian Government has taken the initiative to launch the NPS Vatsalya Scheme 2025 which aimed at encouraging long-term savings for minors. This scheme allow parents and guardians to invest on behalf of their children. NPS Vatsalya Scheme is designed to encourage early savings and investment for children. The parents and guardians can open an account for their minor children and make contributions for their retirement savings under this scheme. The aim of the scheme is to facilitate long-term savings for minors. The scheme is open to all Indian citizens, including NRIs, with parents or guardians acting on behalf of the minor. The account must be registered in the minor’s name, and a Permanent Retirement Account Number (PRAN) card will be issued to the child upon registration.

About NPS Vatsalya Scheme

The Finance Minister of India Nirmala Sitharaman has announced the launch of NPS Vatsalya Scheme. The scheme is designed as an alternative of the existing National Pension System (NPS), which is customized to support younger individuals. The NPS is regulated by the Pension Fund Regulatory and Development Authority (PFRDA) and is known for its flexibility and tax benefits. Parents or guardians can open an account for minors, and upon the child reaching 18, the account can be seamlessly converted into a regular NPS account, ensuring long-term financial security.

This transition ensures that minors have a structured retirement plan in place from an early age. The scheme also allows the option to convert the plan into a non-NPS product once the child reaches adulthood. By enabling parents to start retirement savings for their children early, the NPS Vatsalya Scheme aims to build a financially secure future for the younger generation.

Also Read: Education Loan e Voucher Scheme

Helpful Summary of NPS Vatsalya Scheme

| Name of the Scheme | NPS Vatsalya Scheme |

| Launched By | Government of India |

| Introduced By | The Finance Minister of India Nirmala Sitharaman |

| Regulating Authority | Pension Fund Regulatory and Development Authority (PFRDA) |

| Objective | To create a more financially secure future for the younger generation by allowing parents to start retirement planning for their children at an early stage |

| Benefits | This scheme allow parents and guardians to invest on behalf of their children |

| Beneficiary | Minors under 18 years of age with a PAN Card |

| Contributors | Parents or legal guardians |

| Minimum Contribution | Rs. 1,000 per year |

| Maximum Contribution | No upper limit |

| Investment Options | 1. Default: LC-50 (50% equity); 2. Auto: LC-75, LC-50, LC-25; 3. Active: Custom equity, debt, government bonds |

| Withdrawal | Up to 25% allowed after 3-year lock-in for education, illness, or disability (up to 3 times) |

| Exit Options | More than Rs. 2.5 lakh: 80% for annuity, 20% lump sum withdrawal; Less than or equal to Rs. 2.5 lakh: full withdrawal |

| State | All states of India |

| Year | 2024 |

| Locations | Nearly 75 locations throughout the country |

| Official Website | enps nsdl Portal |

Purpose of NPS Vatsalya Scheme

The purpose of the scheme are as follows:

- The purpose of launching the scheme is to facilitate long-term savings for minors.

- Aim of the scheme is to create a more financially secure future for the younger generation by allowing parents to start retirement planning for their children at an early stage.

- Aims to build a strong financial foundation for minors, supporting their retirement planning from a young age.

- The scheme is designed as an alternative of the existing National Pension System (NPS), which is customized to support younger individuals.

- The scheme aims to allow parents or legal guardians to contribute toward their child’s future, ensuring their financial well-being.

Eligibility Criteria

To avail the benefits under the scheme, applicants should fulfill these eligibility criteria:

- The legal guardian must provide Know Your Customer (KYC) documents, including proof of identity, proof of address, and date of birth for the minor.

- Applicant must be a permanent resident of India.

- Non-Resident Indians (NRIs) can also open an account for their minor children.

- The scheme is available for minors under the age of 18 years.

- The minor must have a valid PAN (Permanent Account Number) card.

- The account must be opened by a parent or legal guardian in the name of the minor.

- Parents or legal guardians are responsible for making contributions to the account until the minor reaches 18 years of age.

Required Documents

To avail the benefit under the scheme, candidates should have these following documents:

- Aadhar Card

- Date of Birth Proof of Minor

- Guardian Signature

- Scanned Copy of Passport (Applicable only for NRI Subscribers)

- Scanned copy of Foreign Address Proof (Applicable only for OCI Subscribers)

- Scanned copy of Bank Proof (Applicable only for NRI/OCI Subscribers)

Salient Features

The salient features of the NPS Vatsalya Scheme are as follows:

- Aimed at minors under 18, with parents or legal guardians contributing on their behalf.

- Requires a minimum annual contribution of Rs. 1,000, with no upper limit.

- The account seamlessly transitions to a regular NPS Tier-1 account when the minor turns 18, after completing KYC.

- A Permanent Retirement Account Number (PRAN) is issued to the minor when the account is opened.

- Offers Default, Auto, and Active investment choices, allowing guardians to allocate funds across equity, debt, and government securities.

- LC-50 (50% equity)

- Aggressive LC-75, Moderate LC-50, or Conservative LC-25

- Custom allocation in equity (up to 75%), debt, government bonds, and alternative assets.

- Allows up to 25% withdrawal after a 3-year lock-in for education, illness, or disability (up to 3 withdrawals).

- After 18, if the corpus exceeds Rs. 2.5 lakh, 80% must be invested in an annuity, and 20% can be withdrawn. For a corpus below Rs. 2.5 lakh, the entire amount can be withdrawn.

- Both resident and NRI parents/guardians can open the account for their minor children.

- Accounts can be opened via Points of Presence (POPs) such as banks, India Post, and the online e-NPS platform.

Contribution Amount and Contributor

- Under the Scheme, parents or legal guardians can contribute on behalf of their minor children. The minimum annual contribution is Rs. 1,000, with no upper limit on contributions. This allows flexibility for parents or guardians to invest according to their financial capacity, ensuring long-term financial security for the child.

Maturity Period

- The NPS Vatsalya Scheme matures when the minor turns 18. At this point, the account transitions into a regular NPS Tier-1 account, continuing as a long-term retirement savings plan beyond the initial maturity period.

Types of Investment

The Scheme offers the following types of investment options:

- Default Choice: Lifecycle Fund LC-50**, with 50% in equity and 50% in debt.

- Auto Choice:

- Aggressive LC-75: 75% equity, 25% debt.

- Moderate LC-50: 50% equity, 50% debt.

- Conservative LC-25: 25% equity, 75% debt.

- Active Choice: Custom allocation across:

- Equity (up to 75%)

- Corporate Debt (up to 100%)

- Government Securities (up to 100%)

- Alternative Assets (up to 5%)

Mode of Withdrawal

- Under the scheme, the modes of withdrawal are:

- Partial Withdrawal: Up to 25% of the contributions can be withdrawn after a 3-year lock-in period for specific purposes like education, illness, or disability, with a maximum of three withdrawals allowed.

- Full Withdrawal:

- Upon turning 18, if the corpus exceeds Rs. 2.5 lakh: 80% of the corpus is used to purchase an annuity, and 20% can be withdrawn as a lump sum.

- If the corpus is Rs. 2.5 lakh or less: The entire amount can be withdrawn as a lump sum.

- In Case of Death: The entire corpus is returned to the designated guardian.

How to Apply Online NPS Vatsalya Scheme 2025

To apply online for the scheme, follow the steps provided below:

Step 1: Visit the official enps website.

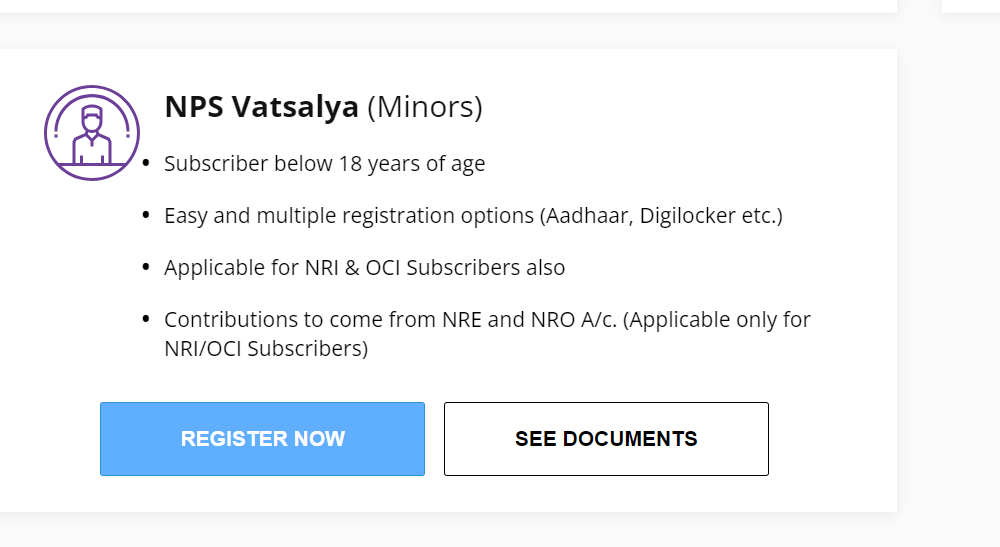

Step 2: On homepage click on “REGISTER NOW” button under “NPS Vatsalya (Minors)” section.

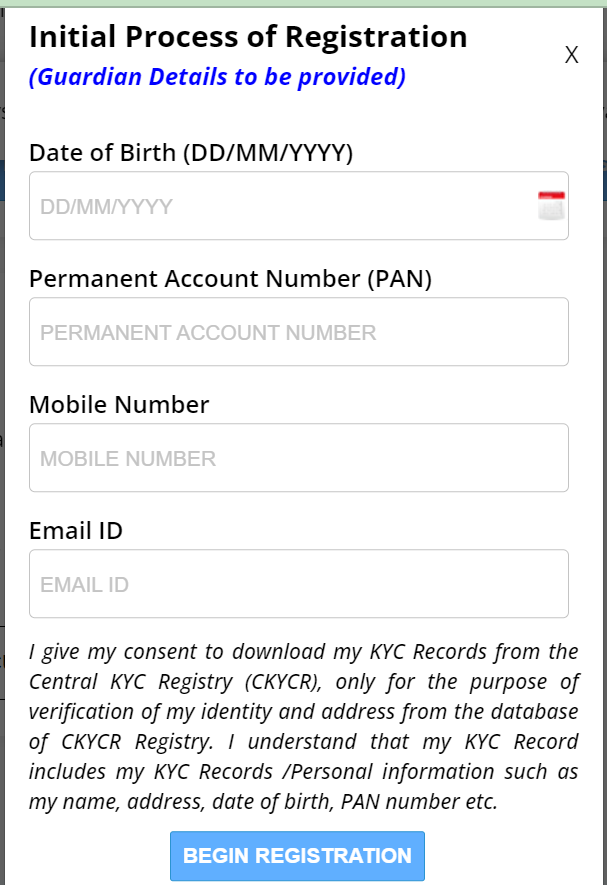

Step 3: Enter your date of birth, Permanent Account Number (PAN), Mobile Number, Email ID and click on “BEGIN REGISTRATION” button.

Step 4: Application form will appear on your screen.

Step 5: Fill the application form with required details asked in the form such as name, address, age and attach the relevant documents.

Step 6: Click on “SUBMIT” button to complete the application process.

Login for NPS Vatsalya Scheme

To login, please follow the below mentioned steps:

Step 1: Visit the official website.

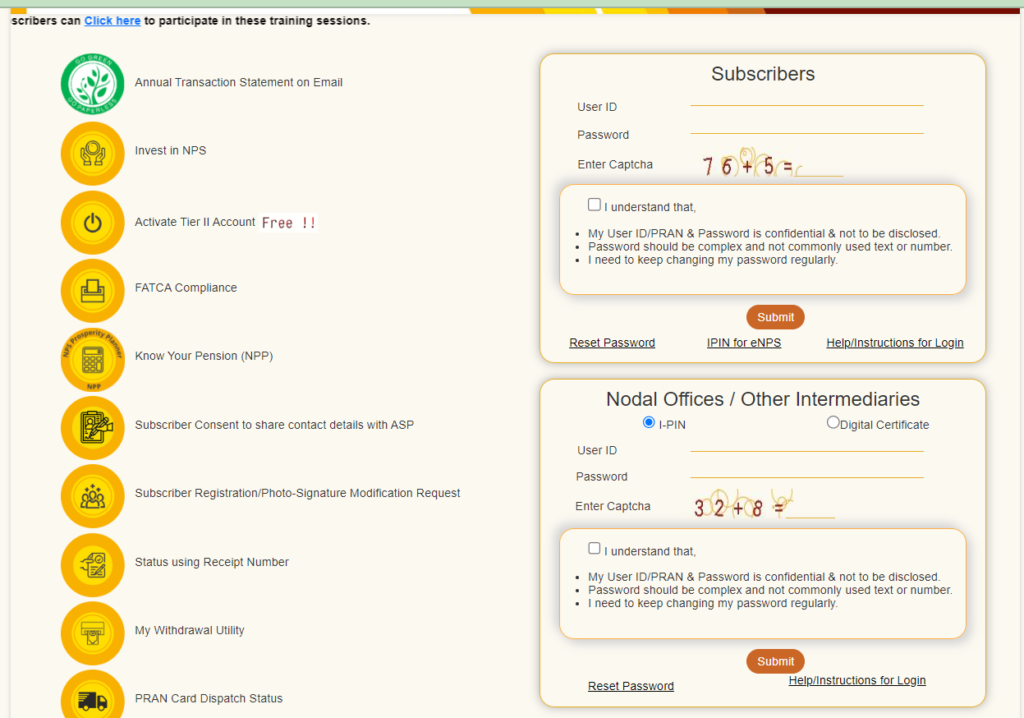

Step 2: On homepage click on “National Pension System (NPS)” option under sub heading “Subscriber” in “Login” section.

Step 3: On another page under “Subscribers” section, enter User ID, Password, and Captcha and click on the box after reading carefully.

Step 4: Click on “Submit” button to complete the login process.

Contact Details

- Address: Protean e-Gov Technologies Limited. 1st Floor, Times Tower, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai – 400 013

- Telephone Number: (022) 2499 3499

- Toll-Free Number For Registered Subscriber: 1800 2100 080

FAQs

What is the key objective of NPS Vatsalya Scheme?

The objective of launching the scheme is to facilitate long-term savings for minors.

What is the benefit of the scheme?

Under the scheme, the parents and guardians can open an account for their minor children and make contributions for their retirement savings.

Who launched the scheme?

The Finance Minister of India Nirmala Sitharaman has launch NPS Vatsalya Scheme.

Who can open an NPS Vatsalya account?

Parents or legal guardians of minors under 18 years of age can open an account. Both Indian citizens and NRIs can open accounts for their minor children.

What are the eligibility criteria for the scheme?

The minor must be under 18 years of age and have a PAN card. The account must be opened by a parent or legal guardian, who must provide KYC documents.

What is the minimum and maximum contribution amount?

The minimum annual contribution is Rs. 1,000, with no upper limit on the amount that can be contributed.