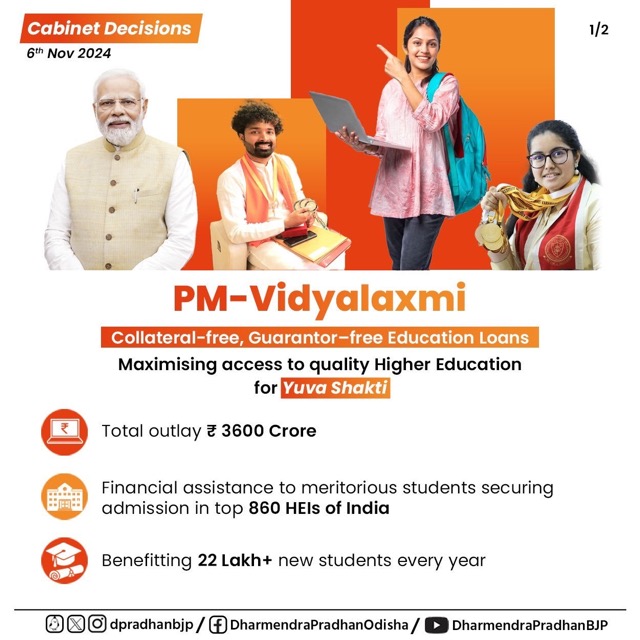

PM Vidyalaxmi Scheme 2025, a new Central Sector initiative that provides financial help to worthy students so that no one is stopped from pursuing higher education by financial limits, has been authorized by the Union Cabinet. With a straightforward digital application process, a special loan program will be launched under the PM Vidyalaxmi scheme to offer school loans without collateral or guarantors. With the help of PM Vidyalaxmi Scheme 2025, a new Central Sector program, qualified students will get financial aid, preventing anybody from being prevented from pursuing higher education because of financial limitations. Keep reading this article further to learn more about PM Vidyalaxmi Scheme Eligibility, Required Documents and Other Details.

What is the PM Vidyalaxmi Scheme?

Any student who is accepted into a quality higher education institution under the PM Vidyalaxmi scheme has the right to receive a loan from a bank or other financial institution that does not require collateral or guarantors to pay for all of their tuition costs and other course-related expenditures. The Union Cabinet has authorized the PM-Vidyalaxmi initiative, which will provide financial aid to worthy students, guaranteeing that no young person’s ability to pay for high-quality higher education would be a barrier. One of the main initiatives of the National Education Policy 2020 is the PM Vidyalaxmi plan, which seeks to give financial aid to deserving students attending public and private higher education institutions.

PM Vidyalaxmi Scheme Eligibility

Income Certificate

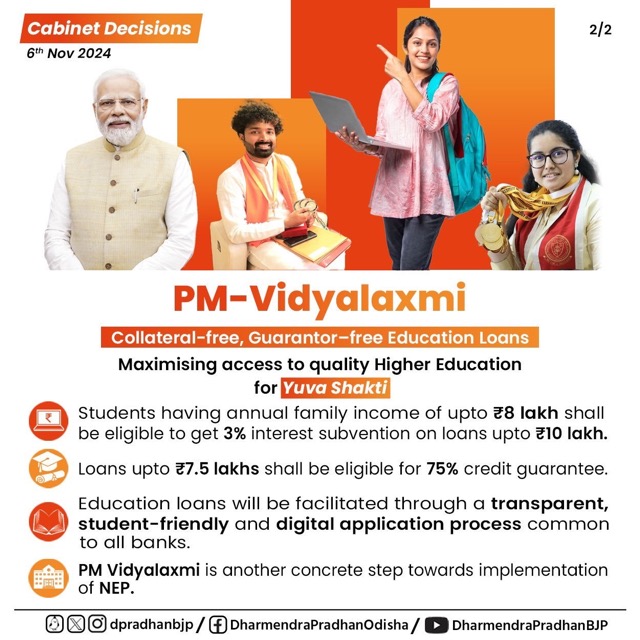

A student’s eligibility for a loan subsidy will be determined by their income. For students with yearly family incomes up to Rs. 8 lakhs, the program would provide a 3% interest subsidy on loans up to Rs. 10 lakhs. Students with yearly household incomes up to Rs. 4.5 lakhs are already eligible for the full interest subsidy.

Quality Higher Education Institutions (QHEIs)

According to the NIRF rankings, the program will be applicable to the Quality Higher Education Institutions only in the country. State government HEIs rated between 101 and 200 in NIRF, all centrally managed institutions, and all HEIs, private and public, that are in the top 100 overall, category-specific, and domain-specific rankings.

Indian Student

The student should be a national citizen or resident of India. He should be eligible for admission in qhei’s as per the regulations of the government.

Education qualifications

Students from government schools who have chosen technical or professional degrees will be given preference.

Also Check: Prime Minister Internship Scheme

Required Documents (Expected)

- Aadhaar Card

- College ID Card

- Income Certificate

- Education Certificates and Documents

- Bonafide Certificate

- Bank Account Number

- Photograph

- Mobile Number

- Email ID

Benefits of PM Vidyalaxmi Scheme

- PM Vidyalaxmi’s plan for 2024 would provide financial aid to eligible students, preventing anybody from being discouraged from going to college due to financial constraints.

- The PM Vidyalaxmi plan, one of the primary programs of the National Education Policy 2020, aims to provide financial help to worthy students enrolled in public and private higher education institutions.

- With a straightforward digital application process, a special loan product will be launched under the PM Vidyalaxmi scheme to offer school loans without collateral or guarantors.

No of Students

- Over 22 lakh students can benefit from this scholarship.

Also Read: PM Vidyalaxmi Scheme College List

Educational institutions Covered

- The initial list consists of 860 qualifying institutions.

- According to the NIRF rankings, the program will be applicable to the Quality Higher Education Institutions only in the country.

Loan Amount and Interest Subvention

- For loans up to Rs 7.5 lakh, the Indian government would offer a 75% credit guarantee, helping banks increase their coverage and assistance for students.

- Students with yearly family incomes up to Rs. 8 lakhs would be eligible for a 3% interest subsidy on loans up to Rs. 10 lakhs under the plan.

- Students with yearly household incomes up to Rs. 4.5 lakhs are already eligible for the full interest subsidy.

Salient Features

- A straightforward, open, and student-friendly system that is entirely digital will be used to run the program.

- Loans up to 10 lakhs will receive a 3% interest subsidy under this program.

- This will only be available to pupils whose family makes 8 lakh rupees a year.

- The program is anticipated to assist 7 lakh new students and has an estimated budget of 3600 crores.

- Students can apply for school loans and seek interest subsidy disbursements using the unified portal “PM-Vidyalaxmi.”

- Under this policy, education loans will be given to students who are accepted into the top 860 reputable universities; around 22 lakh students would be covered annually.

- The loan sums up to help banks increase coverage, the Indian government would offer 7.5 lakh a 75% loan guarantee.

Application Process

Students will be able to apply for education loans and interest subsidies through the Department of Higher Education’s unified portal, PM-Vidyalaxmi. We’ll provide you with the anticipated application process:

Step 1: To begin the application procedure, the candidate should first go to the scheme’s official website.

Step 2: You must click the “apply now” button on the official website’s home page.

Step 3: Following this, you will be sent to a new page where you will be required to provide your complete name, address, email address, cellphone number, and other details.

Step 4: At this stage, you must attach any pertinent papers.

Step 5: You must input the Captcha code in this step and then, to finish the application procedure, click the submit button.

Refrences

FAQs

What is the PM Vidyalaxmi Scheme?

PM Vidyalaxmi Scheme 2024, a new Central Sector initiative that provides financial help to worthy students so that no one is hindered from pursuing higher education by financial limits, has been authorized by the Union Cabinet.

What are the benefits of this scheme?

Under this scheme, students can apply for education loans. Get a subsidy on that loan too.

What are the eligibility criteria for applying under this program?

The applicant should be a permanent resident of the country of India.

What is QHEI?

According to the NIRF rankings, the program will be applicable to the Quality Higher Education Institutions only in the country.