The Government of India launched the Senior Citizen Savings Scheme Calculator (SCSS) 2025. By using the scheme calculator all the citizens of India who have invested under the scheme can check their maturity amount online in the comfort of their homes without visiting anywhere. Senior citizens just need to enter their investment amount and the tenure and interest will be auto-generated by the system to check the maturity amount easily. All the senior citizens of India who want to avail the benefits of the Senior Citizen Savings Scheme can visit the official website and fill out the application form online.

About Senior Citizen Savings Scheme

The Senior Citizen Savings Scheme was launched by the central government of India back in 2004 to provide investment opportunities to the senior citizens of India. With the help of this scheme, senior citizens can invest their money without risking it all. The interest rate under the scheme is also comparatively higher than any other savings account for senior citizens. The interest under the scheme will be paid to the senior citizens every quarter from the date of deposit to 31st March/30th June/30th September/31st December. Senior citizens above the age of 60 years are eligible for the benefits of the Senior Citizen Savings Scheme.

Also Read: Atal Pension Yojana Calculator

The objective of Senior Citizen Savings Scheme Calculator

The main objective of launching the Senior Citizen Savings Scheme is to help the senior citizens of India by providing a suitable investment plan. By using the calculator online senior citizens can get an estimate of the amount they will receive under the scheme. The minimum deposit of INR 1000 can be made by a single account holder under the SCSS. The maximum amount that can be deposited by senior citizens is INR 30 lakh. By determining the maturity amount the senior citizens can plan their retirement accordingly.

Key Highlights of Senior Citizen Savings Scheme Calculator

| Key Highlights | Details |

| Name of the Scheme | Senior Citizen Savings Scheme Calculator |

| Launched By | Government of India |

| Launch Date | 2004 |

| Announced By | Prime Minister of India |

| Purpose | Provide investment opportunity |

| Beneficiaries | Citizens of India |

| Target Beneficiaries | Senior citizen |

| Advantage | High interest rate |

| Eligibility Criteria | Senior citizens above the age of 60 years |

| Required Documents | Aadhaar Card, Bank account, |

| Application Process | Online |

| Official Website | |

| Financial Commitment | |

| Expected Benefits | Provide an interest rate of 8.2% |

| Contact Number | 1800 5700 |

Interest Rate

- The current interest rate under the Senior Citizen Savings Scheme is 8.2%.

Minimum and Maximum Amount

- The minimum deposit of INR 1000 can be made by a single account holder under the SCSS.

- The maximum amount that can be deposited by senior citizens is INR 30 lakh.

Silent Features of the Senior Citizen Savings Scheme

- Easy deposit: With the help of the minimum deposit of INR 1000 financially unstable citizens can also deposit their money under the scheme.

- High interest rate: All the senior citizens who will deposit their money under the scheme will get an interest of 8.2% which is comparatively higher than any other saving account.

- Increase the standard of living: By investing their idol money in the senior citizens can get high returns which help them to increase their standard of living significantly.

- Low risk: Senior citizens can invest their money under the scheme without any worry because the scheme is backed by the government of India.

Senior Citizen Savings Scheme Formula

The formula to calculate the maturity amount and interest for the Senior Citizen Savings Scheme (SCSS) is:

- Maturity Amount = P x (1 + r/n)

- Interest Amount = Compound Interest = P x (1 + r/n) – P

Senior Citizens Savings Scheme (SCSS) Calculator

Maturity Amount: ₹0

Quarterly Interest: ₹0

Total Interest Earned In 5 Years: ₹0

Maturity and Withdrawal

- Account holders can close their account after completing 5 years from the date of opening by submitting the prescribed application form along with other documents like a passbook at the concerned post office.

- After the death of the account holder, the account will earn interest at the rate of the PO saving account from the date of death

- In case the spouse is a joint holder or a sole nominee, the account can be continued till maturity if the spouse is eligible to open an SCSS account and not have another SCSS account.

Premature Closure

- The accounts under the scheme can be prematurely closed anytime after the date of opening.

- If the account is closed before 1 year, no interest will be payable, and any interest paid in the account shall be recovered from the principal.

- If the account is closed after 1 year but before 2 years from the date of opening, an amount equal to 1.5 % will be deducted from the principal amount.

- If the account is closed after 2 years but before 5 years from the date of opening, an amount equal to 1 % will be deducted from the principal amount.

- The extended account can be closed after the expiry of one year from the date of extension of the account without any deduction.

Features of Senior Citizen Savings Scheme Calculator

- To use the Senior Citizen Savings Scheme calculator the citizens must need to enter their deposit amount to get the majority amount.

- The formula that is used by the online calculator to generate the majority amount is Maturity Amount = P x (1 + r/n).

- The maturity period of the deposit under the Senior Citizen Savings Scheme is 5 years.

- By using the calculator the senior citizen can plan their future according to their returns under the scheme.

Benefits of Senior Citizen Savings Scheme Calculator

- The senior citizens of India can easily use the scheme calculator to calculate their return by just entering their deposit amount.

- With the help of the online system of calculating the returns under the scheme, senior citizens did not have to waste their time and effort by visiting government offices.

- Since the calculator is designed by professional programmers the calculator will give you accurate results without any error.

- The SCSS calculator also determines the quarterly interest an account holder would earn during the investment tenure.

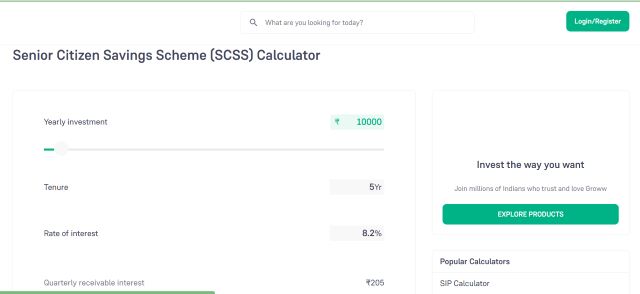

How to Use Senior Citizen Savings Scheme Calculator

STEP 1: All the senior citizens who want to use the Post Office Monthly Income Scheme Calculator are requested to visit the official website by clicking on the link here.

STEP 2: Now the citizens must enter their investment amount. The time period at investment amount will be autogenerated by the system.

STEP 3: The maturity amount will now appear on your desktop screen.

Contact Details

- Phone No:- 1800 5700

FAQs

Who is eligible to available the benefits of the Senior Citizen Savings Scheme?

All the senior citizens of India who are above the age of 60 years are eligible to avail the benefits of the Senior Citizen Savings Scheme.

What is the interest rate under the Senior Citizen Savings Scheme?

The interested under the Senior Citizen Savings Scheme is 8.2%.

What is the tenure of deposit under the Senior Citizen Savings Scheme?

The tenure of deposit under the Senior Citizen Savings Scheme is 5 years.