The government of India launched the UPS Calculator. All the citizens of India who have applied for the unified pension scheme can now at the official website to check the pension amount online. With the help of the online calculator the citizens who have invested their money in the UPS scheme can check the calculator online in the comfort of their home. All the citizens in India who have been Government employees for at least 10 years are eligible to avail the benefits of the UPS scheme. To check the pension amount under the UPS scheme the citizens just need to enter their average monthly basic salary and service years.

About UPS Scheme

The Unified Pension Scheme was announced by the government of India on 24th August 2024 for all government employees. According to the information the scheme will come into effect from 1st April 2025. Under the UPS Scheme, all Government employees who have completed 25 years in service will receive a pension of up to average basic pay over the last 12 months before retirement. Those Government employees who have completed 10 years and service will receive INR 10000 as superannuation. When the Government employees are still in service they have to contribute 10% of their basic salary plus dearness allowance.

Objective of UPS Calculator

The main objective of launching the UPS Calculator is to help Government employees get an estimate of how much pension they will receive by contributing a certain amount of money. With the help of this scheme, the Government of India will provide stability, dignity, and financial security to all Government employees. By getting an estimation of their pension amount the government employees can plan their retirement life accordingly. The programmers have designed the UPS calculator in such a way that it cannot give any errors and will give the visitors an accurate amount.

Key Highlights of UPS Calculator

| Key Highlights | Details |

| Name of the Scheme | UPS Calculator |

| Launched By | Government of India |

| Launch Date | 24th August 2024 |

| Announced By | Prime Minister of India |

| Purpose | Provide investment opportunity |

| Beneficiaries | Citizens of India |

| Target Beneficiaries | Government employees |

| Advantage | Provide pension |

| Eligibility Criteria | Government employees of India |

| Required Documents | Aadhaar Card, Bank account, |

| Application Process | Online |

| Official Website | https://www.npscra.nsdl.co.in/ |

| Expected Benefits | High pension amount |

| Contact Number | 1800-22-7171 |

Interest Rate

- The employers will contribute 18.5% of employee’s basic salary plus dearness allowance.

- The employee will contribute 10% of the basic salary + dearness allowance.

Minimum and Maximum Amount

- The employees have to contribute a minimum of 10% of their basic salary + dearness allowance.

- There is no upper limit under the UPS scheme for the employees.

Silent Features of Unified Pension Scheme

- Secure future: With the help of this scheme the citizen can contribute to having a comfortable post-retirement life.

- Easy to contribute: The Government employees just need to contribute a total of 10% of their basic salary to get the pension amount.

- Assured pension: Retired employees will receive a pension of 50% of their average basic pay over the previous 12 months before retirement. This benefit is provided to employees with at least 25 years of service.

- Employer contribution: The employers also have to contribute 18% of their employee’s basic salary to increase the pension amount significantly.

Unified Pension Scheme Formula

The formula to calculate the pension under the Unified Pension Scheme (UPS) is:

- If the Government employees have completed 25 years or more the pension is 50% of the average monthly basic pay of the last 12 months.

- If the Government employees have completed 10 to 24 years of service then the pension will be a proportionate amount based on the airs of service

- The minimum pension to be given to all the Government employees under the scheme is INR 10,000 per month.

Maturity and Withdrawal

- A lump sum amount is provided to employees upon superannuation, calculated as 1/10th of their last drawn monthly pay for every six months of completed service.

- Employees can withdraw up to 60% of the UPS corpus as a lump sum upon superannuation.

Premature Closure

- The premature closer can happen when the Government employee dies than 60% of the pension employee was receiving.

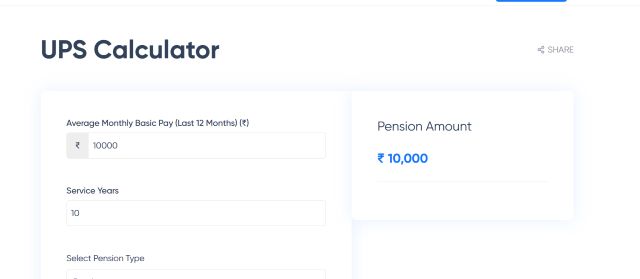

UPS Calculator

Pension Amount

₹ 0.00

Features of Unified Pension Scheme Calculator

- All the Government employees of India who are covered under the UPS scheme are eligible to use the Unified Pension Scheme Calculator.

- The Government employees just need to enter their average monthly basic pay and service year to calculate their pension amount.

- With the help of the online system, Government employees can check their pension amount online in the comfort of their homes without visiting any government office.

- The unified pension scheme calculator does not use any specific formula but there are criteria based upon service years to calculate the pension amount.

Benefits of Unified Pension Scheme

- With the help of the NPS calculator, citizens can instantly check their amount without wasting any time and effort.

- The calculator is programmed by a professional programmer so the citizens do not have to worry about any error in the calculation.

- Since the minimum pension amount under the UPS scheme is INR 10,000 all the Government employees can live their post-retirement life comfortably.

- By checking the returns the citizens can plan their retirement according to the return they will receive.

How to Use Unified Pension Scheme Calculator

STEP 1: All citizens who want to use the National Pension Scheme Calculator are requested to visit the official website by clicking on the link here.

STEP 2: Once the citizens reach the homepage of the official website they must enter their average monthly pay and services.

STEP 3: After entering the details the citizens can easily check their pension amount.

Contact Details

- Phone No:- 1800-22-7171

FAQs

How much percent does the government contribute under the UPS scheme?

A total of 18.5% of the employee’s family salary will the government will contributed under the UPS scheme.

Who is eligible to avail of the benefits of the UPS scheme?

Only the Government employees of India are eligible to avail the benefits of the UPS scheme.

How much percent do the employees contribute under the UPS scheme?

The employees have to contribute a total of 10% of their basic salary plus dearness employees allowance.